Contents

Moral Considerations in AI and Finance

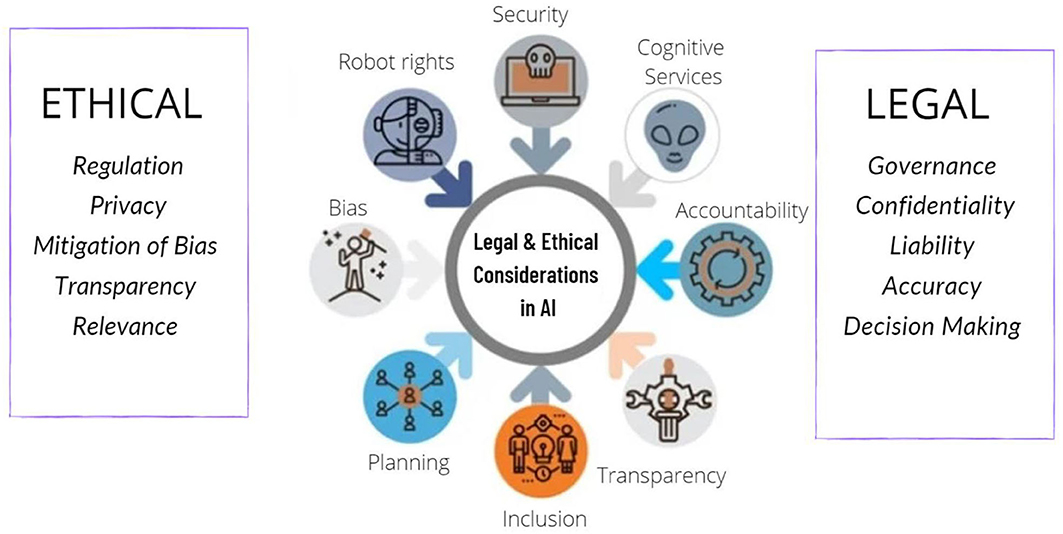

AI expertise has revolutionized the finance trade, providing elevated effectivity and accuracy in decision-making processes. Nevertheless, the mixing of AI in finance additionally raises a number of moral issues that should be addressed to make sure honest and accountable use of this expertise.

Knowledge Privateness and Safety

One of many main moral issues surrounding using AI in finance is the safety of delicate buyer knowledge. As AI techniques depend on huge quantities of non-public and monetary info to make correct predictions and selections, there’s a danger of information breaches or misuse. This will result in identification theft, monetary fraud, and invasion of privateness, elevating questions on who has entry to this knowledge and the way it’s being safeguarded.

Algorithm Bias and Discrimination

One other vital moral concern is the potential for algorithms to exhibit bias and discrimination when making monetary selections. AI techniques are skilled on historic knowledge, which can include biases primarily based on race, gender, or socioeconomic standing. Consequently, these algorithms might inadvertently perpetuate and amplify current inequalities in entry to monetary companies, loans, or funding alternatives. It’s essential to make sure that AI algorithms are designed and examined to attenuate bias and promote equity in decision-making processes.

Transparency and Accountability, What are the moral issues surrounding using AI in finance?

The shortage of transparency and accountability in AI techniques utilized in finance is one other moral concern. As AI algorithms change into extra advanced and complex, it may be difficult to grasp how they arrive at particular selections or suggestions. This opacity can result in a lack of belief from clients and regulators, as they’re unable to evaluate the equity or reliability of those techniques. Monetary establishments should prioritize transparency and accountability within the improvement and deployment of AI applied sciences to make sure that selections are explainable and honest to all stakeholders.

Job Displacement and Financial Impacts

The rising automation of duties within the finance trade by AI applied sciences raises issues about job displacement and its broader financial implications. Whereas AI can streamline processes and enhance effectivity, it additionally has the potential to switch human employees in varied roles, resulting in unemployment and revenue inequality. It’s important for monetary establishments to contemplate the social influence of AI implementation and to put money into retraining packages and help techniques for employees affected by automation.

Regulatory Compliance and Governance

Making certain compliance with current laws and establishing strong governance frameworks for AI in finance is essential to mitigate moral dangers. Regulatory our bodies should preserve tempo with technological developments and develop tips that govern the moral use of AI in monetary companies. Monetary establishments have to prioritize moral issues of their AI methods and make sure that they align with authorized and moral requirements to guard customers and keep belief within the monetary system.

Bias and Equity

AI algorithms in finance can unintentionally perpetuate biases current within the knowledge they’re skilled on, resulting in unfair and discriminatory outcomes. These biases can stem from historic knowledge reflecting societal inequalities, similar to gender or racial biases, which may then be amplified or bolstered by AI fashions.

Biases in AI Fashions

- One instance of bias in AI fashions in finance is using previous mortgage knowledge that will include discriminatory practices. If historic mortgage selections had been biased in opposition to sure teams, AI algorithms skilled on this knowledge might perpetuate the identical biases by unfairly denying loans to people from these teams.

- One other instance is using biased hiring knowledge in monetary establishments. If previous hiring selections had been influenced by biases, AI algorithms utilized in recruitment processes might inadvertently discriminate in opposition to sure demographics, perpetuating the dearth of range within the workforce.

Transparency and Accountability

Within the realm of AI in finance, transparency and accountability play an important function in making certain moral practices and sustaining belief with clients and stakeholders.

Significance of Transparency

Transparency in AI algorithms used for monetary functions is important to offer readability on how selections are made. It permits stakeholders to grasp the reasoning behind outcomes and helps in detecting any biases or errors that will exist within the system. With out transparency, there’s a danger of opacity in decision-making processes, resulting in mistrust and potential moral points.

- Transparency helps in constructing belief with clients by offering insights into how their knowledge is being utilized.

- It allows regulators to evaluate the equity and legality of AI techniques in finance.

- Clear AI algorithms might help in figuring out and addressing biases that will influence the decision-making course of.

Mechanisms for Accountability

Accountability is essential when AI techniques are utilized in monetary establishments to make sure that selections are made responsibly and ethically. There are a number of mechanisms that may be put in place to boost accountability:

- Establishing clear tips and requirements for using AI in monetary decision-making.

- Implementing oversight mechanisms to observe the efficiency of AI techniques and guarantee compliance with laws.

- Creating channels for suggestions and redressal in case of errors or biases in AI-driven selections.

Knowledge Privateness and Safety: What Are The Moral Considerations Surrounding The Use Of AI In Finance?

What are the moral issues surrounding using AI in finance? – Relating to using AI in finance, knowledge privateness and safety are of utmost concern. The implications of using huge quantities of non-public knowledge in AI-driven monetary companies increase moral questions and potential dangers.

Implications of Utilizing Private Knowledge

AI algorithms in finance rely closely on private knowledge similar to monetary historical past, spending habits, and even delicate info like social safety numbers. The gathering and evaluation of this knowledge can result in issues relating to privateness invasion and knowledge misuse.

Safeguarding Client Knowledge

Measures should be put in place to safeguard shopper knowledge and forestall breaches in AI-powered monetary techniques. Encryption, strict entry controls, common audits, and compliance with knowledge safety laws are essential steps to make sure knowledge privateness and safety.